Year 2 of the Deshaun Watson era in Cleveland did not go according to plan for team or player in 2023. A lingering shoulder injury limited the high-priced passer to six games and set off a number of changes made in the lineup at the quarterback position. The Browns managed to post a record of 11-6 while relying on Joe Flacco down the stretch and managing a slew of other ailments on offense.

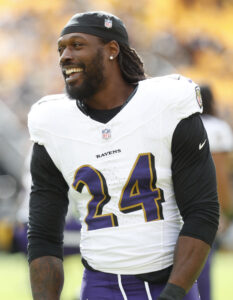

Nick Chubb is among the key players still on the mend for Cleveland as the team looks to improve on a 2023 wild-card berth. Stability on the sidelines and in the front office should help that effort, and the Browns return one of the league’s top defenses. Once again, however, attention will be placed on Watson’s ability to stay on the field and deliver on his fully guaranteed contract. Three years remain on his monster pact, one which is set to carry a record-breaking cap charge in 2024.

Trades:

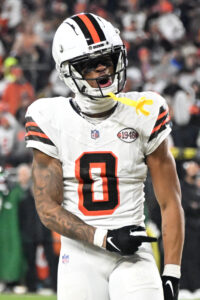

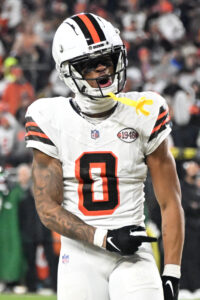

Amari Cooper has delivered during his time in Cleveland, racking up over 2,400 yards and 14 touchdowns across the past two years. The five-time Pro Bowler has thus served as a needed No. 1 wideout on his third career team, but finding consistent complementary options has been an organizational priority recently. Elijah Moore was acquired via trade last March, and the same was true of Jeudy one year later.

The latter struggled to live up to expectations in Denver, with his best campaign coming in 2022 (during which he posted a 67-927-6 statline). Jeudy – alongside fellow Broncos wideout Courtland Sutton – was frequently mentioned as a trade candidate near the past two trade deadlines, but no move was made in either case. The Broncos then set a high trade price on Jeudy — a first-round pick — during the 2023 offseason. The first year with Sean Payton at the helm was beneficial for Sutton’s production much more than it was for Jeudy’s. Months later, the team was willing to move on for a much lower return.

The former first-rounder made it known after his Cleveland arrival that he asked to be dealt ahead of the 2023 campaign. Payton rejected that request at first, but Jeudy repeated it after the campaign, one in which his statistical output took a step back. The fact the Alabama product was entering a contract year at the time of the swap helps explain the underwhelming trade terms from Denver’s perspective. Jeudy quickly worked out a multiyear extension with the Browns, however, eliminating the chance of a free agent departure after his fifth-year option season.

That three-year, $52.5MM deal contains $41MM in guarantees. It ensures Jeudy will remain in place through 2027 and represents a rather notable investment in his ability to develop into at least a consistent starting option. Numerous receiver deals have eclipsed the value of Jeudy’s pact in recent months, but Cleveland is clearly banking on solid play from him with or without Cooper leading the way down the road.

A trio of Cooper, Jeudy and Moore should give the Browns their best WR room since the Watson acquisition. Especially if Chubb misses time early in the campaign, an efficient passing game will be key to the Browns’ success on offense. If Jeudy acclimates well in an environment he chose to enter, the former No. 15 overall pick will be a key contributor in that regard.

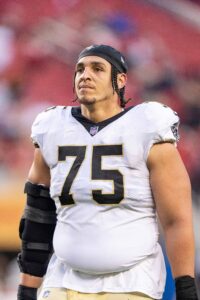

Harris played out his rookie contract with the Browns, making 40 appearances and four starts. He departed on the open market by taking a one-year Seahawks deal worth $2.51MM and thus earning the chance to compete for a starting role. Seattle recently signed Connor Williams, however, providing the team with a more experienced option in the middle.

The Browns, meanwhile, have run into injury trouble at center. The latest example of that was backup Luke Wypler suffering an ankle injury in the team’s preseason opener which will require surgery. Harris, 25, will thus return to Cleveland in position to serve as a No. 2 option to Ethan Pocic. The trade saw Harris and a seventh-round pick come back in return for a sixth-rounder.

Free agency additions:

- Jordan Hicks, LB: Two years, $8MM ($4.5MM guaranteed)

- Jameis Winston, QB: One year, $4MM ($4MM guaranteed)

- Quinton Jefferson, DT: One year, $4MM ($3.66MM guaranteed)

- Nyheim Hines, RB: One year, $1.5MM ($850K guaranteed)

- Justin Hardee, CB: One year, $1.38MM ($800K guaranteed)

- Devin Bush, LB: One year, $1.5MM ($500K guaranteed)

- Tyler Huntley, QB: One year, $1.29MM ($470K guaranteed)

- D’Onta Foreman, RB: One year, $1.29MM ($335K guaranteed)

- Tony Brown, CB: One year, $1.13MM

- Giovanni Ricci, TE: One year, $1.11MM

- Cade York, K: One year, $985K

- Wyatt Davis, OL: One year, $985K

Hicks’ arrival will allow him to reunite with defensive coordinator Jim Schwartz. The pair worked together in Philadelphia at the start of Hicks’ career. The former third-rounder developed into a full-time starter during that span, notching five interceptions in 2016. He turned in a healthy three-year stretch in Arizona before spending the past two seasons with the Vikings.

Hicks’ arrival will allow him to reunite with defensive coordinator Jim Schwartz. The pair worked together in Philadelphia at the start of Hicks’ career. The former third-rounder developed into a full-time starter during that span, notching five interceptions in 2016. He turned in a healthy three-year stretch in Arizona before spending the past two seasons with the Vikings.

Hicks was limited to 13 games in 2023, but he still managed a fifth consecutive season with triple-digit tackles. The 32-year-old may not be expected to replicate his production against the pass from his Eagles tenure, but he should handle starting duties with his fourth team. Cleveland’s edge rush and secondary are set to remain strong in 2024. Still, the linebacker position faces questions marks. Hicks should provide dependable first-team play at a reasonable cost.

Bush, by contrast, represents a low-risk, high-reward investment. The former top-10 pick failed to live up to expectations in Pittsburgh, leading to a one-year Seahawks deal last offseason. Bush, 26, played sparingly on defense and was not a key special teams contributor. This season will provide him with another opportunity to carve out a rotational role and thus help his market value, though.

While Joe Flacco expressed interest in a new Browns deal after his surprisingly successful tenure to close out the season, Cleveland explored other backup options. That led to Winston connections quickly developing. The Browns were known to have the former No. 1 pick on their radar ahead of the new league year, although they were joined in that respect by the Titans and Giants.

Winston has continued to express interest in a starting gig despite serving as a Saints backup for most of the past four seasons. The 30-year-old’s last full campaign in a No. 1 role was 2019, when he memorably closed out his Buccaneers tenure with 33 touchdowns and 30 interceptions. Watson’s history of missed time with the Browns certainly suggests the door could open to notable playing time for Winston this season. In that event, the latter could help his free agent stock considerably with a strong showing. At a minimum, though, the former No. 1 overall pick should provide the team with a veteran backup capable of handling first-team duties over an extended stretch if needed.

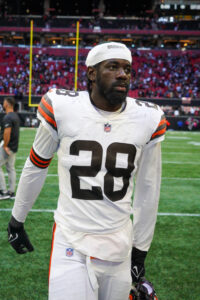

Watson and Winston occupy the top two spots on the QB depth chart, and Huntley is in competition with 2023 fifth-rounder Dorian Thompson-Robinson for the No. 3 gig. After joining the Ravens as a UDFA, Huntley made a total of 10 starts (including one in the playoffs) across four seasons. That experience led to interest from the Steelers and could give him a leg up on Thompson-Robinson (whose struggles as a rookie helped inform the move to Flacco as starter), but limited guarantees make Huntley’s hold on a roster spot a tenuous one.

Jefferson spent five of his first seven NFL seasons in Seattle, but he has not managed to find a long-term home in recent years. The 31-year-old played single campaigns with the Bills (2020), Raiders (2021) and Jets (2023) while remaining a regular contributor at every stop. Jefferson set a new career high in sacks last season with six, and he has posted at least three every year since 2018. While his deal pales in comparison to the one Dalvin Tomlinson landed last offseason, Jefferson should be counted on as a key contributor along the interior for Cleveland.

With Chubb’s health and return timeline a question mark, it came as little surprise the Browns made multiple backfield additions. Hines suffered an ACL tear during an offseason jet ski accident, and he missed the 2023 campaign as a result. The chance to reunite with offensive coordinator Ken Dorsey (after working with him in Buffalo) and handle the role of returner appealed to Hines when making his free agent decision. If the former Colts contributor can regain his previous form upon returning to health, he could thrive as a pass-catching specialist and third-phase producer.

Foreman’s path to a roster spot is narrower. The 28-year-old entered training camp in competition with Pierre Strong Jr. for the third spot on the RB depth chart. That role will be in place only until Chubb returns, of course, and neither player has considerable guaranteed money on their contract. Foreman’s 4.2 career yards per carry average could make him an attractive option for outside teams during roster cutdowns if he becomes available, though.

Re-signings:

- Za’Darius Smith, DE: Two years, $23MM ($12MM guaranteed)

- Shelby Harris, DT: Two years, $9MM ($3.99MM guaranteed)

- Corey Bojorquez, P: Two years, $4MM ($2.75MM guaranteed)

- Michael Dunn, OL: One year, $1.29MM ($1.15MM guaranteed)

- Maurice Hurst, DT: One year, $1.8MM ($1MM guaranteed)

- Rodney McLeod, S: One year, $1.38MM ($768K guaranteed)

- James Proche, WR: One year, $1.13MM

- Sam Kamara, LB: One year, $985K

The Browns did not make any major splashes in terms of adding outside free agents, and Smith was the only player listed amongst PFR’s top 50 options on the open market. The three-time Pro Bowler made his return to the AFC North last offseason by taking a one-year Cleveland pact. A former Ravens draftee, Smith remained productive when healthy during his time with the Packers (2019-21, 26 sacks) and Vikings (2022, 10 sacks). A first-team role awaited him upon arrival with the Browns, but his 5.5 sacks were his fewest in a full campaign since 2017.

The Browns did not make any major splashes in terms of adding outside free agents, and Smith was the only player listed amongst PFR’s top 50 options on the open market. The three-time Pro Bowler made his return to the AFC North last offseason by taking a one-year Cleveland pact. A former Ravens draftee, Smith remained productive when healthy during his time with the Packers (2019-21, 26 sacks) and Vikings (2022, 10 sacks). A first-team role awaited him upon arrival with the Browns, but his 5.5 sacks were his fewest in a full campaign since 2017.

Nevertheless, Smith landed a notable deal to remain with the Browns. The former fourth-rounder received a signing bonus of nearly $11MM, and he will collect a $2MM roster bonus early in 2025. Smith should be expected to remain Myles Garrett’s main complement, although Ogbonnia Okoronkwo logged a career-high 53% snap share in his debut Browns campaign. The latter posted 4.5 sacks, and continued development could cut into Smith’s playing time and production moving forward.

While Jefferson will take on a notable workload with Cleveland, Harris should also maintain a key rotational role given the team’s decision to retain him through 2025. The 33-year-old’s snap share in 2023 (42%) was his lowest since 2015, and his statistical output took a step back as a result. Harris has starting experience dating back to his time with the Broncos and Seahawks, however, so he will be capable of handling an uptick in usage if injuries or poor play become an issue for Cleveland’s new arrivals on the D-line.

McLeod was not a full-time starter in 2023, his first season with the Browns. That made this past campaign the first since his rookie year in which he did not start every contest. The 12-year veteran gave thought to retiring after this past season, one in which a biceps injury limited him to 10 games. However, he will carry on for one more year in search of a second Super Bowl ring. McLeod will again offer Cleveland a highly experienced backup behind Grant Delpit and Juan Thornhill in 2024.

Bojorquez has spent the past two seasons with the Browns after his time with the Bills and Packers. The New Mexico alum led the NFL in yards per punt during the 2020 season, and while he has not been able to duplicate that feat in recent years he has remained consistent. Keeping Bojorquez in the fold will allow Cleveland to have multiyear continuity on special teams with kicker Dustin Hopkins and long snapper Charley Hughlett still in place for 2024 and beyond.

Notable losses:

- Matthew Adams, LB

- Harrison Bryant, TE

- Geron Christian, T

- Jeff Driskel, QB

- Jordan Elliott, DT

- Joe Flacco, QB

- Mike Ford, CB

- Lonnie Phelps, DE (waived)

- Jacob Phillips, LB

- Sione Takitaki, LB

- Anthony Walker, LB

- Phillip Walker, QB

Flacco first joined the Browns in November, and he made his first start in Week 12. The former Super Bowl MVP’s level of play over the next five weeks (4-1 record, 13 touchdown passes, 90.2 passer rating) quickly put to rest questions about who would serve as starter during the playoffs with Watson sidelined. Flacco was rested for Cleveland’s meaningless regular-season finale, but he was not at his best in the wild-card round. A two-interception game (bringing his total in that department to 10 on the year) ended in a 45-14 loss to the Texans.

Flacco first joined the Browns in November, and he made his first start in Week 12. The former Super Bowl MVP’s level of play over the next five weeks (4-1 record, 13 touchdown passes, 90.2 passer rating) quickly put to rest questions about who would serve as starter during the playoffs with Watson sidelined. Flacco was rested for Cleveland’s meaningless regular-season finale, but he was not at his best in the wild-card round. A two-interception game (bringing his total in that department to 10 on the year) ended in a 45-14 loss to the Texans.

In the aftermath of that contest, it appeared a mutual interest existed between team and player for their relationship to continue. To that end, the 2023 Comeback Player of the Year was surprised he wound up needing to find a new home in free agency. The Eagles made an offer for what would have been a reunion after Flacco spent part of the 2021 season in Philadelphia. Instead, the team would up trading for Kenny Pickett.

Flacco signed with the Colts to serve as a replacement for Gardner Minshew. Indianapolis will hope to have better health from Anthony Richardson in 2024, something which would keep Flacco in the role of mentor. The 39-year-old has shown, however, that under the right circumstances he can step in on short notice and keep an offense afloat if needed despite his age.

Read more

The mass exit at the linebacker spot will have an effect on both defense and special teams. Takitaki and Walker combined to play over 1,000 defensive snaps last year, each serving as key members of Jim Schwartz’s unit. The former had spent his entire five-year career in Cleveland, so being without him for the first time since 2018 will be noteworthy. The latter started all but one of his games across his three years with the Browns, and Hicks will be tasked with taking on a significant workload as his replacement.

Phillips did not play in 2023 due to injury, but in his brief 2022 campaign he logged a 72% snap share. The missed time limited his value on the open market, which resulted in a low-cost Texans deal. Still, not having Phillips in place could test the Browns’ depth if injuries become an issue. Likewise, Adams’ absence will be felt on special teams if his level of play in that department is not adequately replaced by the numerous new faces at the position.

Elliot logged a rotational role during the first two seasons of his rookie contract. Over the past two years, he was a full-time starter alongside Tomlinson. The 26-year-old totaled 4.5 sacks and six QB hits since the start of 2022, and his modest production against the pass earned him a two-year, $7MM deal with the 49ers. San Francisco released Arik Armstead this offseason, a move which should pave the way for Elliott to remain a regular moving forward.

Extensions and restructures:

Cooper was one of many receivers around the league whose contract situation was a point of contention this offseason (something which is still the case for some wideouts, of course). As team and player hoped, though, a resolution emerged before any potential training camp holdout could take place. The 30-year-old’s salary was set to lock in ahead of Week 1 anyway, but this move converted nearly $19MM into a signing bonus and in doing so allowed him to be paid up front.

Cooper was one of many receivers around the league whose contract situation was a point of contention this offseason (something which is still the case for some wideouts, of course). As team and player hoped, though, a resolution emerged before any potential training camp holdout could take place. The 30-year-old’s salary was set to lock in ahead of Week 1 anyway, but this move converted nearly $19MM into a signing bonus and in doing so allowed him to be paid up front.

2024 remains the final year of Cooper’s pact – one signed in 2020 with the Cowboys – but the terms of the restructure have Cleveland set to carry a dead cap charge of over $22MM next season without an extension being worked out before the 2025 league year. The Browns have expressed a desire to keep him around beyond the coming season, although the Jeudy investment and the cumbersome nature of Deshaun Watson’s cap charges beginning this year could make that a challenge.

Cooper’s production has not suffered from age or a rotating cast of quarterbacks. His future in Cleveland or elsewhere following the season will thus remain worth watching closely, especially considering the nature of the receiver market. A notable new deal should be in store regardless of where it comes from provided 2024 consists of another high-end output.

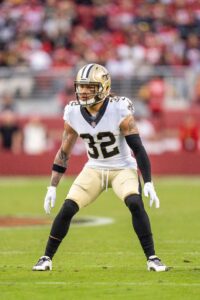

Owusu-Koramoah was known to be on the Browns’ extension radar well before his pact was worked out. He is now on the books through 2027 as a core member of the team’s resurgent defense. The 24-year-old secured $25MM in total guarantees, and his $12.5MM AAV ranks sixth in the league amongst off-ball linebackers.

The Notre Dame product saw notable playing time on defense and special teams as a rookie before seeing an uptick in usage during an injury-shortened 2022 campaign. This past season produced career highs in tackles (101), sacks (3.5) and his first two interceptions. Owusu-Koramoah earned a Pro Bowl nod as a result and cemented his status as one of the league’s top young linebackers with respect to defending the pass in particular.

PFF has not graded the former second-rounder’s tackling well during the early portion of his career, but his pass rush (84.2) and coverage (70) marks stood out in 2023. Remaining strong in those departments would prove the Browns’ investment to be a worthwhile one. Given the many changes made at the LB spot this offseason, Owusu-Koramoah will be counted on to provide needed continuity at the second level during the coming season and beyond. Effective play at the position from a team perspective will depend in large part on his ability to repeat his success against the pass while developing further on early downs.

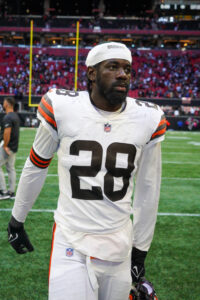

Chubb’s gruesome Monday Night Football injury sidelined him for the year and led to questions about his Browns future. Two operations were required to repair the damage done to his MCL (although, encouragingly, his ACL remained intact). The four-time Pro Bowler was floated as a potential cut candidate, but the restructure — effectively a pay cut — confirmed he will remain in place with the Browns for at least one more year.

Chubb, 28, received $2.05MM guaranteed as part of the reworking of his pact; incentives are in place which will allow him to earn back at least some of the money he was originally due. Of course, much of his 2024 compensation will depend on when he next takes the field and how close his is to his previous form upon return. The longtime 1,000-yard rusher began training camp on the PUP list, and he may remain there at the start of the regular season. A reserve/PUP designation would require at least a four-week absence, a timeline which would come as no surprise given the severity of the injury.

Chubb, 28, received $2.05MM guaranteed as part of the reworking of his pact; incentives are in place which will allow him to earn back at least some of the money he was originally due. Of course, much of his 2024 compensation will depend on when he next takes the field and how close his is to his previous form upon return. The longtime 1,000-yard rusher began training camp on the PUP list, and he may remain there at the start of the regular season. A reserve/PUP designation would require at least a four-week absence, a timeline which would come as no surprise given the severity of the injury.

Still, the Browns are optimistic Chubb will play at some point in 2024. His return would provide a major boost to Cleveland’s running game provided he can replicate his past success. Jerome Ford topped 1,100 scrimmage yards in 2023 and he is set to handle lead-back duties until Chubb is back in the fold. But the team’s upside on the ground should increase once both members of that tandem are available.

Cade York joined Cleveland with high expectations in 2022, but his rookie campaign was followed by struggles in the subsequent offseason. The team intended to keep him on the practice squad (something which could be possible this year), but his departure eliminated any doubt that Hopkins would handle kicking duties. The latter delivered his most accurate season to date while debuting in Cleveland, connecting on 91.7% of his field goals. That mark included going eight-for-eight on attempts beyond 50 yards.

At an AAV of $5.3MM, Hopkins sits in a tie for seventh in terms of annual kicker compensation. The 33-year-old’s deal preceded Evan McPherson in landing a multiyear extension with an AFC North team this offseason. The division now houses four of the top 11 kickers in terms of annual compensation, each of whom being attached to an average of at least $5MM per season. On the books through 2027, Hopkins will have the opportunity to duplicate his success from last season and in doing so prove this commitment to be a sound one.

Draft:

- Round 2, No. 54: Michael Hall (DT, Ohio State) (signed)

- Round 3, No. 85: Zak Zinter (G, Michigan) (signed)

- Round 5, No. 156 (from Eagles through Cardinals): Jamari Thrash (WR, Louisville) (signed)

- Round 6, No. 206 (from Ravens): Nathaniel Watson (LB, Mississippi State) (signed)

- Round 7, No. 227 (from Titans): Myles Harden (CB, South Dakota) (signed)

- Round 7, No. 243: Jowon Briggs (DT, Cincinnati) (signed)

2024 marked the third and final year in which the Browns did not have a first-round pick as a result of the Watson trade. That blockbuster deal left the team in need of adding key cost-controlled players after Day 1 to supplement the three-time Pro Bowler. Watson’s tenure has not gone according to plan so far, but this year’s class has the chance to help the team make another postseason appearance.

While Hall’s situation has been complicated by a domestic violence arrest, his on-field appeal was easy to see coming into the draft. Across the past two seasons, the Cleveland-area native demonstrated his athletic upside while making plays against the run and pass. Hall posted 7.5 tackles for loss and 4.5 sacks in 2022; following that up with a career-high 24 total stops last season showed the impact he can make in several situations at the NFL level.

Generating depth along the defensive interior has been a key priority in recent years, and Elliott’s departure (along with the decision to move on from Perrion Winfrey last summer) leaves a rotational role available for Hall. The 6-3, 290-pounder should be counted on to contribute right away, and he has the upside to develop into a full-time starter down the road. Though, an early-career suspension is certainly on the radar.

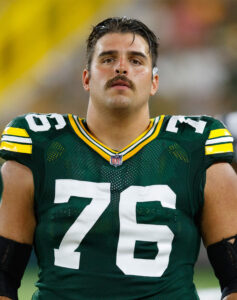

Since 2019, Joel Bitonio and Wyatt Teller have combined to form one of the league’s best guard tandems. The former has earned a Pro Bowl nod in each of the past six years, while the latter has received three in a row. Both players are under contract through 2025, but cost-effective depth is imperative given their respective cap hits.

Zinter spent his full four-year college career with the Wolverines. The Jim Harbaugh recruit’s performances leading up to the 2023 season landed him a pair of All-Big Ten honors, but this past campaign added further to his accolades. The 6-6, 320-pounder earned another All-Conference nod while also being recognized as a unanimous All-American. Zinter will not see the field in 2024 unless Bitonio or Teller miss time, but he could find himself in the starting lineup once one or both members of the pairing see their contracts expire.

Additions made on Day 3 from both sides of the ball could offer depth contributors at a number of positions. Much of the 2024 class’ effectiveness will of course come down to how Hall and Zinter perform at the NFL level, though. The former college rivals figure to have notable roles later in their rookie contracts in particular.

Other:

With a pair of playoff appearances in their four-year run together, Stefanski and Berry have offered a level of success not seen for a generation in Cleveland. Of course, the pair’s legacy will be fundamentally tied to the Watson acquisition and the team’s postseason runs (or lack thereof) with him under center. Plenty of time remains for Watson to prove his arrival to be worthwhile, but in any case the core built in large part by Berry will be responsible for returning Cleveland to the playoffs in 2024.

With a pair of playoff appearances in their four-year run together, Stefanski and Berry have offered a level of success not seen for a generation in Cleveland. Of course, the pair’s legacy will be fundamentally tied to the Watson acquisition and the team’s postseason runs (or lack thereof) with him under center. Plenty of time remains for Watson to prove his arrival to be worthwhile, but in any case the core built in large part by Berry will be responsible for returning Cleveland to the playoffs in 2024.

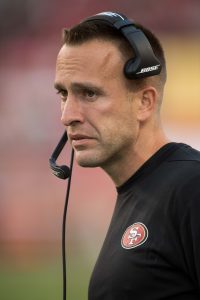

Stefanski, who earned his second Coach of the Year award last season, saw his stock rise during his lengthy tenure on the Vikings’ staff. This included a single season as offensive coordinator in 2019. As expected, his Browns teams have been effective on the ground (during Nick Chubb’s healthy seasons), ranking no worse than sixth in rushing between 2020 and ’22. Cleveland’s passing attack has lacked by comparison with the exception of this past season, when Chubb’s absence led to a reliance on an aerial attack. An offseason featuring numerous staff changes included the decision to part ways with Van Pelt.

The veteran staffer was given the opportunity to remain in Cleveland in a different capacity, but as in many cases around the league that offer was turned down. Van Pelt had been in place since Stefanski’s arrival, so 2024 will be notable in the sense that it will feature a new OC for the first time. On the other hand, Stefanski handled play-calling duties with Van Pelt in place, and that will continue now that Dorsey is in the fold.

The latter took over as offensive coordinator of the Bills in 2022 after Brian Daboll’s departure. His second season in charge did not go as well as hoped, and midway through the campaign Buffalo elected to move on and promote Joe Brady. That move resulted in a decidedly run-first approach and left Dorsey free to move on to a new situation. The 43-year-old assistant will not call plays in his new environment, but a strong showing in Cleveland would help rebuild his stock for more involved OC gigs in the future.

Vrabel, 49, was one of the numerous veteran coaches left without a position once the HC vacancies had been filled. His Titans tenure included a trip to the AFC title game in 2019 and a Coach of the Year nod two years later. As Tennessee transitioned away from several veterans, however, the team went 13-21 across the past two seasons. Ownership committed to general manager Ran Carthon’s roster-building outlook and tapped Brian Callahan to oversee Will Levis’ development. Set to handle a consultant position in Cleveland, Vrabel will not have a role on gamedays as he aims to put himself back on the head coaching radar.

Part of the Browns’ success on defense has been the strong play of their starting cornerback trio. Denzel Ward is attached to the league’s second-most valuable contract at that position ($20.1MM per season). Martin Emerson Jr., meanwhile, will be eligible for an extension next offseason. The 2022 third-rounder has posted four interceptions and 29 pass deflections to date, so keeping him in the fold will be expensive with Ward on the books for another four years.

That reality has led to speculation about Newsome’s future beyond the 2025 season. The Northwestern alum wants to remain in Cleveland on a multiyear pact, and Berry confirmed before the draft a trade never received consideration. No extension talks took place during the spring, though, and none are known to have occurred more recently. As Newsome (who set career highs across the board in 2023) prepares for another campaign featuring high expectations, his contract status will be worth watching closely.

One of the NFL’s top offseason storylines, Aiyuk’s future remains unclear. After the 49ers allowed his camp to seek out an extension with outside teams, the Browns emerged as a serious suitor. As was the case with the Patriots, however, the second-team All-Pro did not show interest in playing in Cleveland despite a trade arrangement being worked out. Aiyuk would have represented another young receiver acquisition in 2024, and one carrying substantially higher expectations than the Jeudy pickup.

One of the NFL’s top offseason storylines, Aiyuk’s future remains unclear. After the 49ers allowed his camp to seek out an extension with outside teams, the Browns emerged as a serious suitor. As was the case with the Patriots, however, the second-team All-Pro did not show interest in playing in Cleveland despite a trade arrangement being worked out. Aiyuk would have represented another young receiver acquisition in 2024, and one carrying substantially higher expectations than the Jeudy pickup.

Especially considering the commitment made to Cooper, it was interesting he was a key element in Cleveland’s reported offer to the 49ers on an Aiyuk trade; the Browns also are believed to have included second- and fifth-round picks. With the Arizona State product having turned aside Browns interest, Cooper will remain atop Cleveland’s depth chart for at least one more season – albeit with questions looming about the team’s preparedness to follow through on its publicly stated interest in making a new commitment to him.

Top 10 cap charges for 2024:

- Deshaun Watson, QB: $63.77MM

- Myles Garrett, DE: $20.17MM

- Denzel Ward, CB: $12.14MM

- Joel Bitonio, G: $12.14MM

- Wyatt Teller, G: $11.61MM

- Jack Conklin, T: $10.56MM

- David Njoku, TE: $9.65MM

- Amari Cooper, WR: $8.74MM

- Dalvin Tomlinson, DT: $6.5MM

- Nick Chubb, RB: $6.28MM

By virtue of the Browns’ decision not to repeat the restructure executed last offseason, Watson’s cap charge will break an all-time NFL record. As things stand, he is set to count nearly $64MM on the team’s cap sheet in 2025 and ’26 as well, and any future maneuvering will no doubt be influenced by his performance this year. Only Cooper and Chubb (whose value will of course be largely dictated by his health and output in 2024) are pending free agents of the 10 listed, so continuity among at least many of Cleveland’s core players can be expected moving forward.

Watson has returned to full health in time for the 2024 season, one in which he will once again be at the center of attention aimed at the Browns. A double-digit win season is possible without him in the picture for an extended period, as last year showed. The Jeudy trade and the Cooper arrangement (not to mention attempts at trading for Aiyuk) demonstrate the emphasis placed on upgrading the passing game, though, something which has kept Watson’s potential in mind.

All four of the AFC North’s teams finished the 2023 campaign with a winning record, and the division figures to be among the NFL’s strongest once again this year. Cleveland’s nucleus on the field, the sidelines and in the front office has remained intact in advance of a campaign which comes with notable expectations attached to it.

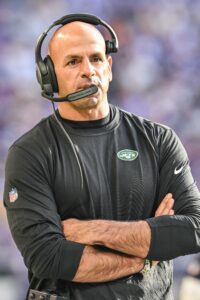

With the organization again failing to make the playoffs, both the head coach and the GM found themselves on the hot seat. Of course, even the most basic context would indicate that 2023’s failures couldn’t entirely be attributed on the duo, and Woody Johnson seemed to share that sentiment when he announced that he’d retain his HC/GM tandem. Reports of paranoia from within the organization hint that there could be cracks in the foundation, but ownership is willing to give the franchise architectures at least one more shot (this time with a healthy Aaron Rodgers).

With the organization again failing to make the playoffs, both the head coach and the GM found themselves on the hot seat. Of course, even the most basic context would indicate that 2023’s failures couldn’t entirely be attributed on the duo, and Woody Johnson seemed to share that sentiment when he announced that he’d retain his HC/GM tandem. Reports of paranoia from within the organization hint that there could be cracks in the foundation, but ownership is willing to give the franchise architectures at least one more shot (this time with a healthy Aaron Rodgers). The Jets appeared to have it all figured out when they acquired Haason Reddick from the Eagles. The organization had just let Bryce Huff walk to Philly on a lucrative deal, and with Reddick no longer in the Eagles’ plans, the Jets swooped in and acquired the veteran. Unfortunately, Reddick decided to play hardball in pursuit of a contract extension, leading to one of the organization’s biggest offseason headaches in recent years.

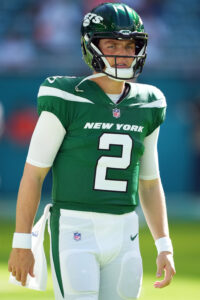

The Jets appeared to have it all figured out when they acquired Haason Reddick from the Eagles. The organization had just let Bryce Huff walk to Philly on a lucrative deal, and with Reddick no longer in the Eagles’ plans, the Jets swooped in and acquired the veteran. Unfortunately, Reddick decided to play hardball in pursuit of a contract extension, leading to one of the organization’s biggest offseason headaches in recent years. The Jets were not done making trades, with the organization finally ripping off the human-sized Band-Aid that was quarterback Zach Wilson. There was once hope that the former No. 2 overall pick would help lead a rebuilt Jets squad to the promised land. After struggling as a rookie and failing as a sophomore, the Jets pivoted to veteran Aaron Rodgers as their new QB savior. Still, the organization was confident that Wilson could be a future contributor while learning under Rodgers’ tutelage. Instead, Wilson was thrust right back into the lineup.

The Jets were not done making trades, with the organization finally ripping off the human-sized Band-Aid that was quarterback Zach Wilson. There was once hope that the former No. 2 overall pick would help lead a rebuilt Jets squad to the promised land. After struggling as a rookie and failing as a sophomore, the Jets pivoted to veteran Aaron Rodgers as their new QB savior. Still, the organization was confident that Wilson could be a future contributor while learning under Rodgers’ tutelage. Instead, Wilson was thrust right back into the lineup.